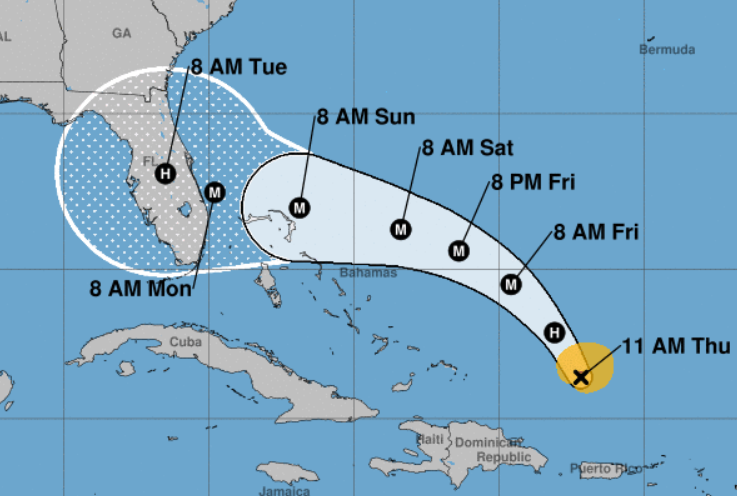

As Hurricane Dorian threatens Florida and the southeast U.S., and with the peak of hurricane season just ahead, taxpayers in potentially affected areas are being urged to develop an emergency preparedness plan. Taxpayers, whether individuals, organizations or businesses, should take time now to create or update their emergency plans.

The IRS says taxpayers can begin getting ready for a disaster with a preparedness plan that includes securing and duplicating essential documents, creating lists of property and knowing where to find information once a disaster has occurred.

Secure key documents and make copies Taxpayers should place original documents such as tax returns, birth certificates, deeds, titles and insurance policies inside waterproof containers in a secure space. Duplicates of these documents should be kept with a trusted person outside the area a natural disaster may affect. Scanning them for backup storage on electronic media such as a flash drive is another option that provides security and easy portability.

Document valuables and equipment Taking photographs or videos of a home or business’s contents can help support claims for insurance or tax benefits after a disaster strikes. All property, especially expensive and high value items, should be recorded. The IRS disaster-loss workbooks can help individuals and businesses compile lists of belongings or business equipment.

Employers should check fiduciary bonds Employers who use payroll service providers should ask the provider if it has a fiduciary bond in place. The bond could protect the employer in the event of default by the payroll service provider. The IRS also encourages employers to create an EFTPS.gov account where they can monitor their payroll tax deposits and sign up for email alerts.

Rebuilding documents Reconstructing records after a disaster may be required for tax purposes, getting federal assistance or insurance reimbursement. Taxpayers who have lost some or all of their records during a disaster should visit IRS’s Reconstructing Records webpage.

IRS stands ready In the case of a federally-declared disaster, taxpayers can visit the IRS webpage for information or call 866-562-5227 to speak with an IRS specialist trained to handle disaster-related issues. A taxpayer impacted by a disaster outside of a federally declared disaster area may qualify for disaster relief. This includes taxpayers who are not physically located in a disaster area, but whose records necessary to meet a filing or payment deadline postponed during the relief period are located in a covered disaster area. Taxpayers located outside of a federally declared disaster area must self-identify to receive relief by calling 866-562-5227.

Related items:

- Publication 2194, Disaster Resource Guide for Individuals and Businesses

- Publication 583, Starting a Business and Keeping Records

- FS-2017-11, Reconstructing Records After a Natural Disaster or Casualty Loss

- Tax Relief in Disaster Situations

- Federal Emergency Management Agency

- Small Business Administration

- Disasterassistance.gov

- Ready.gov

For more information about National Preparedness Month, visit Ready.gov/September.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs